EXECUTIVE SUMMARY –

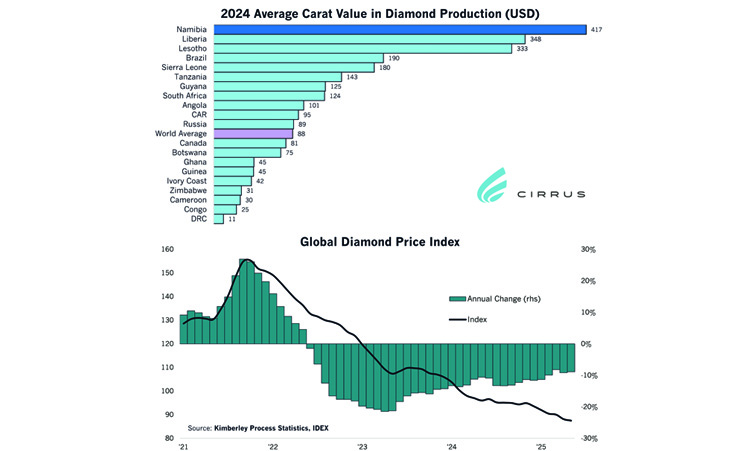

Global diamond prices have collapsed due to structural competition from cheaper lab-grown diamonds, but Namibia’s high-quality mined diamonds have remained comparatively resilient, dropping only 30% versus much steeper global and regional declines. Despite producing just 2% of global diamond volume, Namibia now accounts for over 10% of global diamond value, as premium stones continue to command strong prices even amid market uncertainty and shifting consumer preferences.

Keywords:

Namibia, diamonds, lab-grown diamonds, premium diamonds, global price collapse, Botswana diamonds, Idex Index, festive-season demand, sustainability trends, U.S. tariffs, India diamond processing

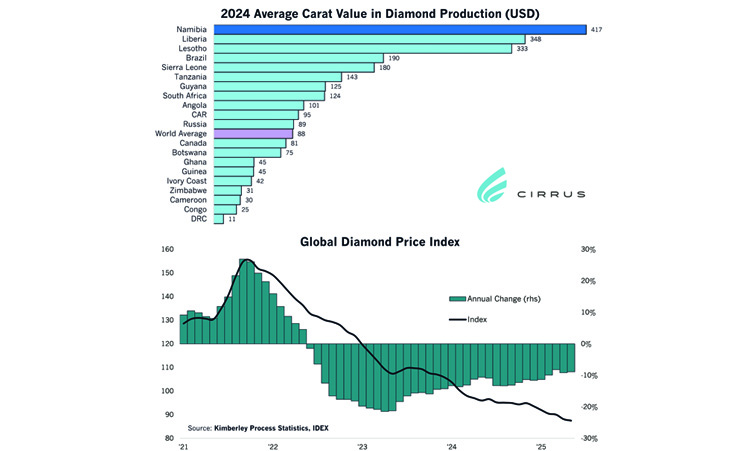

GLOBAL diamond prices have been in decline for the past few years, with the Idex Diamond Price Index down nearly 50% since its peak in March 2022.

Although the diamond market has seen downturns before, these have generally been cyclical, driven by global economic factors.

The current downturn is clearly a structural one, as more affordable lab-grown diamonds (LGDs) continue to compete aggressively with mined diamonds.

With the price collapse showing no sign of stopping, or even decelerating, jewellers are no longer stockpiling diamonds, as they expect prices to be lower tomorrow.

It is generally agreed that LGDs are around 10% to 20% of the price of an equivalent mined diamond.

However, lower-quality, smaller mined diamonds face greater pressure from LGDs, while higher-quality, larger mined diamonds have proved more resilient.

Within the mined diamond market, there is therefore a clear shift towards the premiums.

Given this, Namibian diamonds – the most valuable diamonds produced in the world – have been holding their ground more effectively than those of other producers.

While Namibian diamonds have still dropped in price (30% since the 2022 peak), this decline is less dramatic than the 50% fall in average global prices, and the 66% decline in prices for Botswana’s diamonds.

Namibia also benefits from a stronger seasonal uptick than its peers, with prices rising more sharply around the festive season.

Although Namibia produces only about 2% of global diamond volume, it accounts for just over 10% of global diamond value – its highest share in history, as other producers scale back while Namibia’s diamonds prove more resilient, continuing to command high prices.

The diamond market remains sluggish amid United States tariff uncertainty, including a 50% tariff on India, a primary importer of diamonds for further processing. Indian diamond manufacturing firms are reportedly considering relocating to Dubai to escape these tariffs.

In addition, shifting consumer preferences towards greener, more sustainable and more ethical options have put further pressure on mined diamonds.

SOURCE: https://www.namibian.com.na/namibias-forever-diamonds/